Crypto is down but stable as Bitcoin’s hash rate and difficulty rise. And now, as institutions buy and FOMO subsides, does altcoins news suggest the market is about to rip high into a crypto bull run?

The total crypto market cap might be down, shrinking 1.7% to around $3.2 trillion in the past 24 hours, but optimism is high.

Of importance, Bitcoin

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

Price

Volume in 24h

<!–

?

–>

Price 7d

, despite a wavy week, is trading above $97,000. Over the weekend, prices were stuck within a tight range and below $100,000.

This price action spilled over to altcoins, which were also tight. Cardano, Solana, Dogecoin, and BNB didn’t register major losses and are mostly in the green over the last trading week.

(Source)

Now, the question remains: With sellers slowing down, are prices flattening ahead of the much-needed recovery?

Analysts, after examining on-chain and macro events over the last week, are convinced this could be the case.

Reason #1: Bitcoin Hash Rate and Difficulty Rising

Bitcoin is the most valuable coin by market cap and dominates market share.

Therefore, how it performs, both on-chain and price-wise, can determine how altcoins perform.

Currently, mining farms are funneling resources, securing the network as they hope to emerge from other competing pools. Subsequently, the hash rate has been rising and currently stands at around an all-time high.

By February 9, the hash rate, a measure of computing power, stood at 826 EH/s, slightly lower than the 835 EH/s registered a day earlier.

(Source)

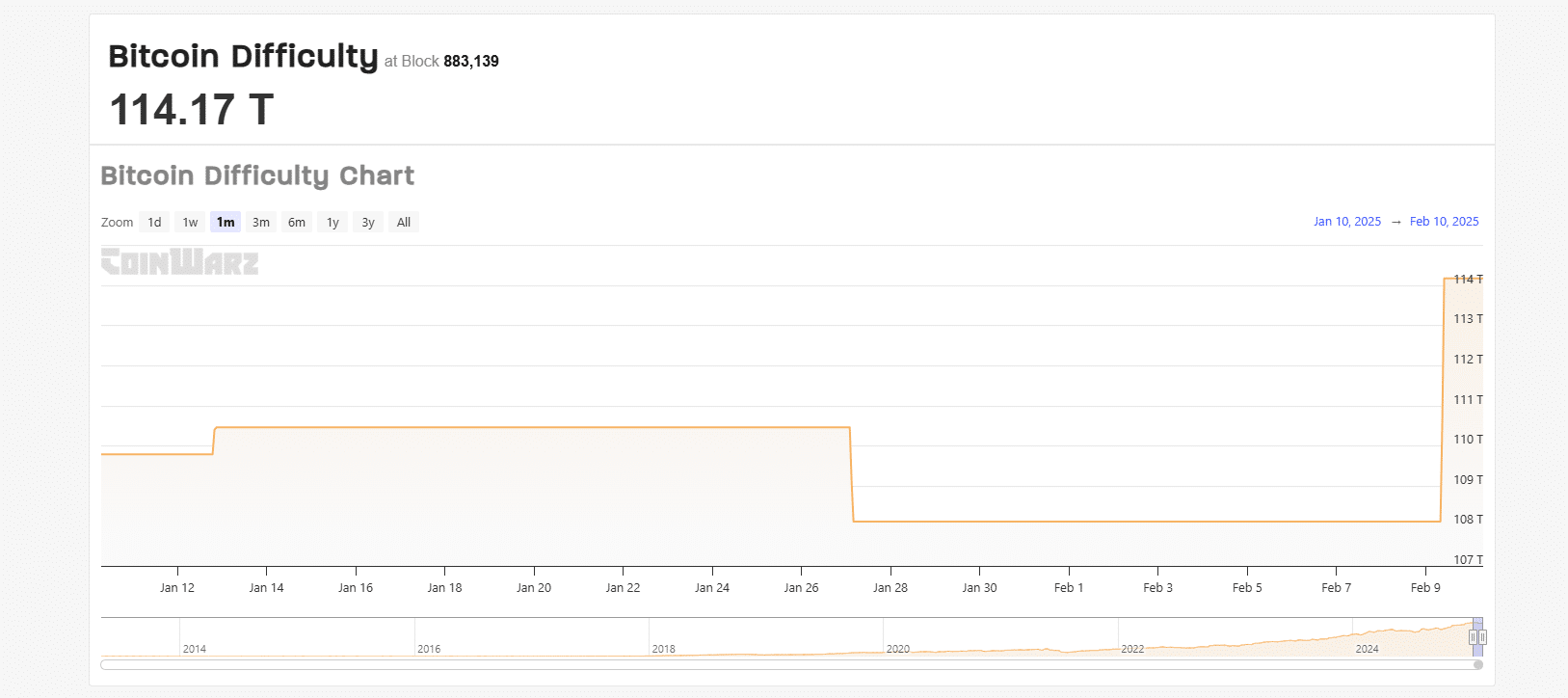

Meanwhile, the rising hash rate has forced the network to re-adjust difficulty positively. According to Coinwarz, Bitcoin mining difficulty is at 114.17T, up 5.61% from 108T.

(Source)

Rising hash rate and difficulty signal increasing investor confidence and infrastructure expansion, a solid ground for gains.

Reason #2: ‘Smart Money’ Institutional Adoption Drives Demand For Crypto Bull Run

As miners funnel resources, institutions are also looking to gain exposure. In addition to MicroStrategy, now called Strategy, the University of Austin recently established a Bitcoin investment fund within its $200 million endowment.

The decision follows Emory University’s earlier move to invest over $15 million in spot Bitcoin ETFs issued by Grayscale.

Emory University reported $15.8m worth of $BTC, the first endowment to report a bitcoin ETF position. With that every institution type is now represented in the btc etf 13Fs (endowment, bank, HF, Ins Co, Advisor, Pension, PE, Holding Co, Vc, Trust, Family Office, Brokerage).… pic.twitter.com/eefYpEbXRn

— Eric Balchunas (@EricBalchunas) October 28, 2024

Often, institutions tend to hold on to their stash and not sell like retailers. Therefore, their involvement only points to one thing: Sustained demand.

They now join pension funds, family offices, public companies, and even billionaires who continue to get BTC exposure.

According to Soso Value, institutions have cumulatively bought over $113 billion. On February 7 alone, over $171 million of spot Bitcoin ETF shares were bought.

(Source)

Bitcoin and Crypto Resilience Despite Zero Adverts During The Super Bowl

The crypto market is surprisingly resilient, shaking off last week’s weakness.

While some believe crypto bulls are on their last “legs,” prices are steady and didn’t sell off despite the lack of crypto ads in the 2025 Super Bowl, where Donald Trump was in attendance.

Good news is there hasn’t been a single crypto ad the entire Super Bowl so the bull market can continue

— Cydel (@cydelmg) February 10, 2025

It follows a trend seen in the past two years, especially after the collapse of FTX. Without adverts, it may suggest that the crypto market is becoming less reliant on FOMO and other hype-driven events and is maturing into a more stable asset class.

Instead, in the past few months, crypto players have focused on sustainable growth and education and are looking to onboard more institutions.

EXPLORE: 10 Coins with High Returns: Crypto Forecast 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Here’s 3 Reasons The Crypto Bull Run is Just Getting Started appeared first on 99Bitcoins.