- 76% of top DOGE traders on Binance currently hold long positions.

- Exchanges have witnessed an outflow of $18 million worth of DOGE.

During the ongoing market uncertainty, where most assets are experiencing notable price declines and facing selling pressure, Dogecoin [DOGE], the largest memecoin, is gaining significant attention from crypto enthusiasts.

On the 16th of February, investors and intraday traders were notably bullish on the memecoin, as the on-chain analytics firm Coinglass reported.

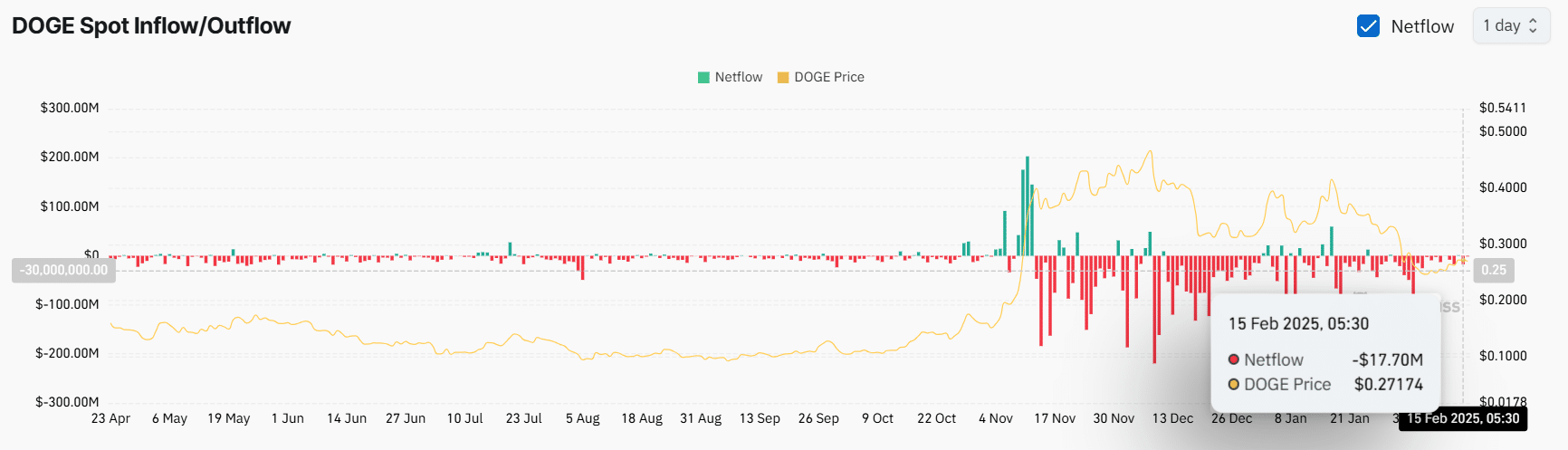

$18 million worth of DOGE outflow

Data from Spot Inflow/Outflow analysis showed that cryptocurrency exchanges have witnessed an outflow of a significant $18 million worth of DOGE. The trend indicates potential accumulation.

Source: Coinglass

This substantial outflow from exchanges has occurred in the past 24 hours and also has the potential to create buying pressure.

76% of DOGE traders go long

When it comes to whales or long-term holders making strong bullish bets, intraday traders are showing the same enthusiasm, heavily favoring long positions.

Data revealed that Binance’s DOGE/USDT long/short ratio was at 3.15, at press time.

This means that for every 3.15 long positions, there is a single short position. The data indicates a strong bullish sentiment among Binance traders.

Apart from this, 76% of top DOGE traders on Binance held long positions as of this writing, while 24% held short positions.

Source: Coinglass

Current price momentum

However, despite these bullish on-chain metrics, they have not impacted DOGE’s price. As of this writing, the memecoin was trading near $0.26 and has experienced a price drop of over 3.5% in the past 24 hours.

During the same period, its trading volume declined by 45%, indicating lower participation from traders and investors compared to the previous day.

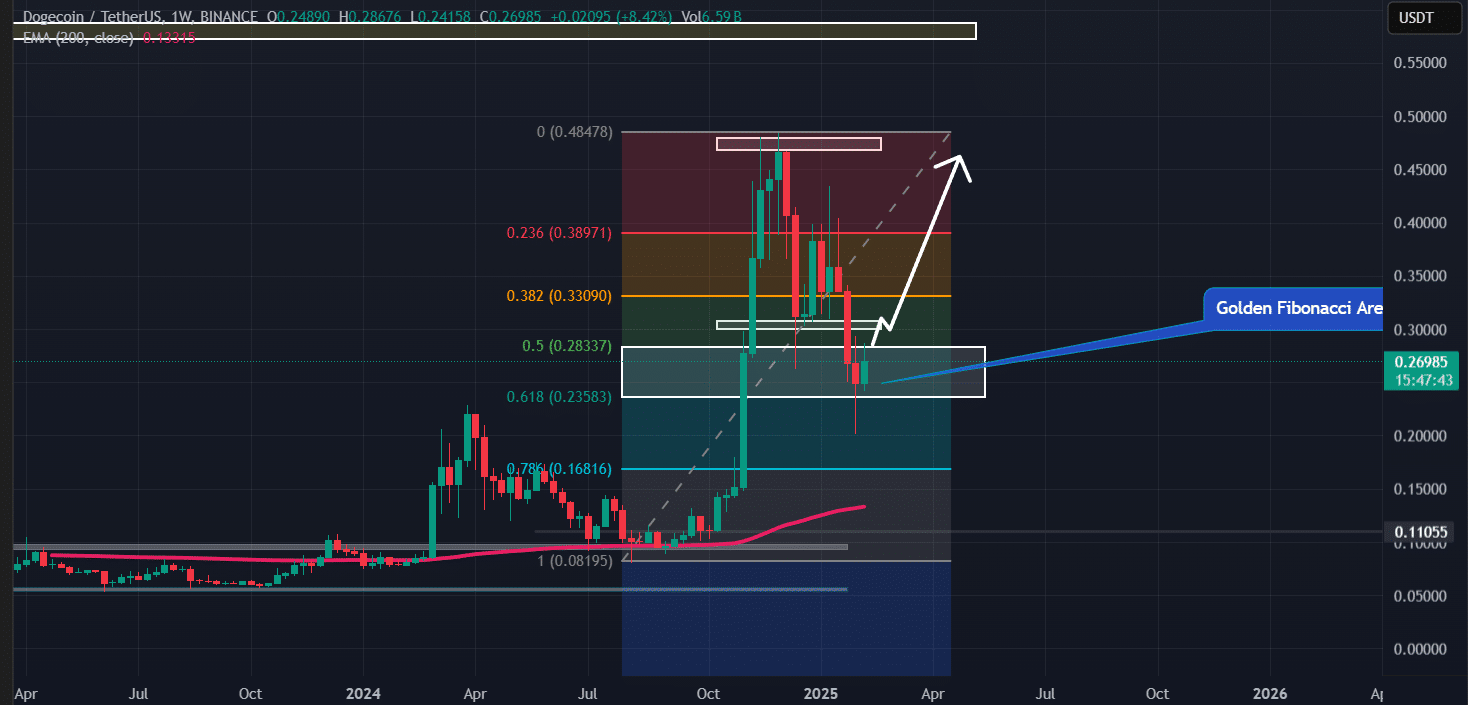

DOGE technical analysis and key-level

According to AMBCrypto’s technical analysis, DOGE has been trading within the golden Fibonacci zone, between the 50% and 61.8% levels, on the daily time frame.

This could be the reason behind traders’ and investors’ bullish outlook. In trading and investing, experts consider this level an ideal opportunity to go long.

Source: TradingView

However, the current market sentiment appears to be creating a hurdle, preventing DOGE from breaching the $0.28 resistance level.

Based on recent price action and historical patterns, if DOGE breaks this resistance and closes a daily candle above $0.28, there is a strong possibility it could soar by 35% to reach $0.39 in the coming days.

On the positive side, DOGE is trading above the 200 Exponential Moving Average [EMA] on both the weekly and daily time frames, indicating that the asset is in an uptrend.

When combining these on-chain metrics with technical analysis, it appears that DOGE could soon breach the resistance level that has been acting as a hurdle for the meme coin.

Source: https://ambcrypto.com/dogecoin-rally-soon-whats-next-as-76-doge-traders-bet-long/