- Bitcoin Dominance showed bearish divergence as the market shifts toward alternative assets.

- Does this signal investors moving away from BTC?

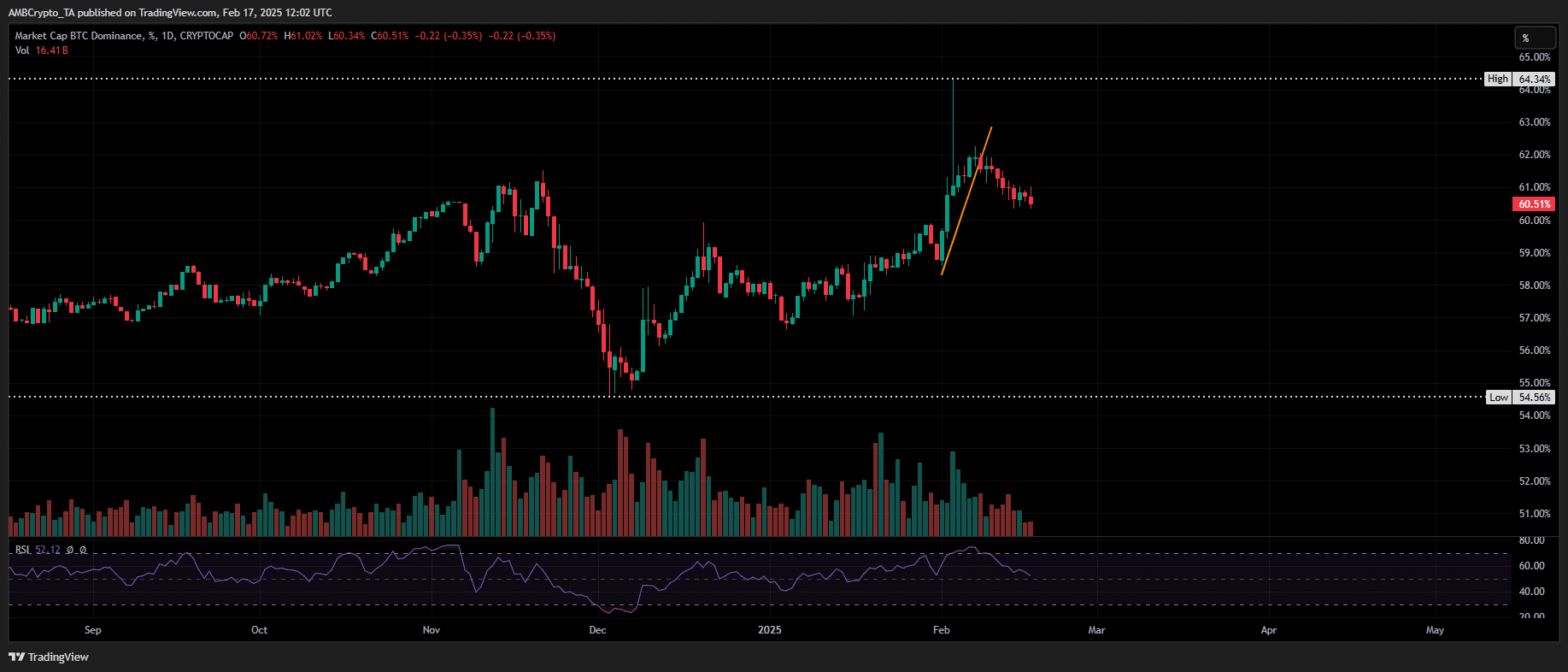

Bitcoin [BTC] Dominance (BTC.D) was showing a bearish divergence, suggesting that its market share relative to the total crypto market cap is weakening.

However, the Relative Strength Index (RSI) not yet giving a sell signal means that momentum hasn’t fully shifted bearish – yet.

Is Bitcoin preparing for a retreat, or is this merely a temporary cooling-off period?

A critical week ahead for Bitcoin

BTC.D shot up 5% in early February after a market-wide shakeup triggered by Trump’s tariff stance, wiping out over $420 billion in crypto market cap.

Source: TradingView (BTC.D)

As panic spread, Bitcoin held strong while altcoins crumbled, with most high-cap altcoins hitting new lows against BTC.

History shows that Bitcoin’s consolidation often sparks altcoin rallies. In Q2 last year, when BTC hovered between $60K and $70K, Ethereum’s [ETH] soared with its longest green candlestick, posting a 19% daily gain.

With high-cap altcoins already showing weekly gains, this trend might be ready to play out again. Bitcoin futures traders should stay cautious. Sentiment is bullish, with more long positions stacking up.

However, with a bearish divergence in play, billions are at risk of liquidation in the coming days, setting the stage for a potential long squeeze.

Is this shakeup just a temporary cooldown?

This month, Bitcoin has shed over $1 trillion in market cap, dropping from a peak of $2.10 trillion at the end of January.

With sentiment sinking into fear, a BTC rebound still feels far off.

If its dominance slides further, we could see the fear index dive into ‘extreme’ territory, setting the stage for potential panic selling. This is something to keep an eye on in the coming days.

Source: CoinMarketCap

However, there’s a slight uptick in the index, with momentum now neutral. The RSI hasn’t fully flipped bearish yet, leaving room for a possible turnaround.

Altcoins are seeing a 5% correction in daily price action, suggesting the recent surge could be nothing more than a cooldown phase – rather than the start of a full-blown altcoin season.

Still, to prevent the RSI from hitting a low, keeping a close watch on the futures market is key, as it could pose the biggest threat to Bitcoin’s dominance.

Source: https://ambcrypto.com/bitcoin-dominance-flashes-warning-signs-for-btc-traders-why/