Join Our Telegram channel to stay up to date on breaking news coverage

Recent developments in the regulatory landscape could shape the future of digital assets, with industry leaders weighing in on upcoming policies. Lightspark CEO David Marcus recently discussed former President Donald Trump’s cryptocurrency strategy, calling it a potential turning point for the industry.

In light of this, investors seek promising projects with strong growth potential for portfolio addition. As the market evolves, low-cost cryptocurrencies may benefit from a more favorable environment, making identifying affordable tokens with strong fundamentals essential. As such, Insidebitcoins compiles the best cheap crypto to buy now under 1 dollar.

5 Best Cheap Crypto to Buy Now Under 1 Dollar

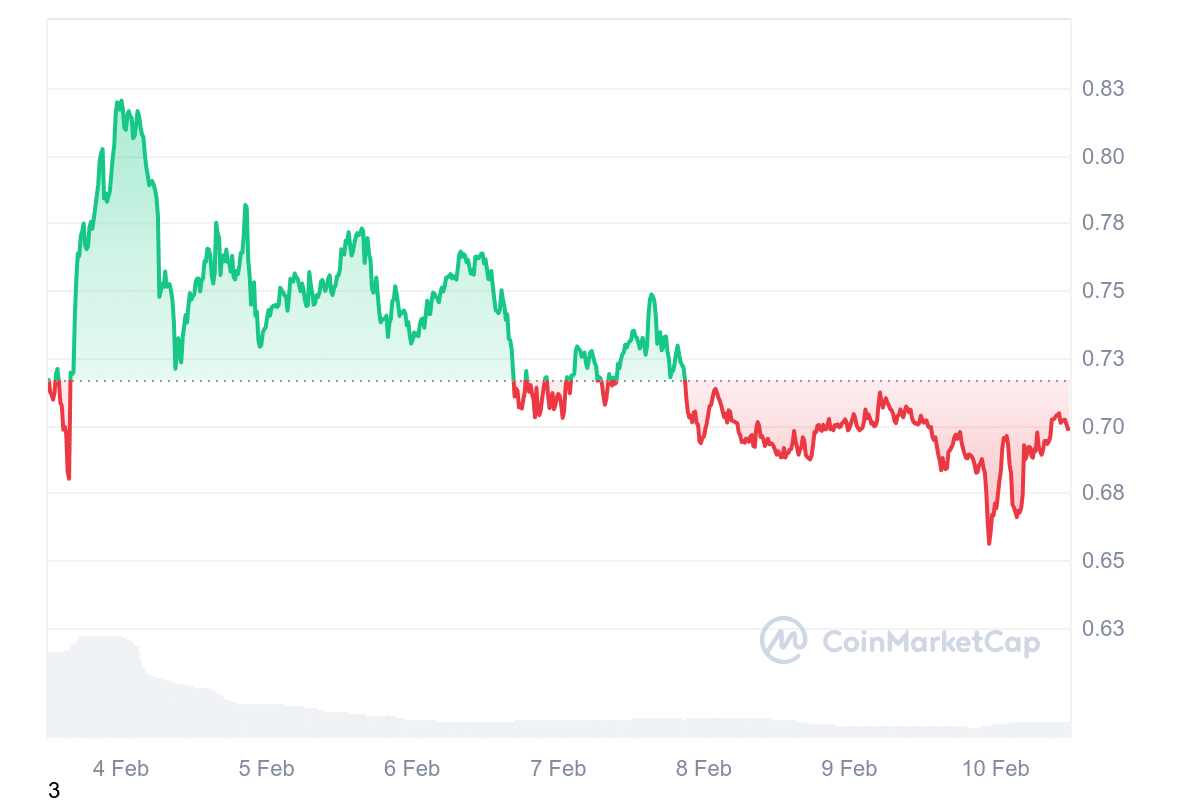

Arbitrum (ARB) has gained momentum through new integrations and technological advancements. Its value is $0.4626, marking a 4.94% rise over the past week. Meanwhile, Onyxcoin (XCN) is progressing with the launch of its Layer 3 blockchain, the XCN ledger. Algorand (ALGO) has demonstrated consistent growth. It is currently valued at $0.2867, reflecting a 3.09% increase in the past day. Cardano (ADA), on the other hand, experienced a 0.62% decline in price, settling at $0.701, though its trading volume surged by 45.53% to $776.23 million in the last 24 hours.

Solaxy (SOLX) remains in its presale stage, priced at $0.00163, with expectations of a price adjustment in the upcoming round. Meanwhile, XRP has declined while Bitcoin has shown upward movement, raising questions about the broader impact of recent market developments on cryptocurrency valuations.

1. Arbitrum (ARB)

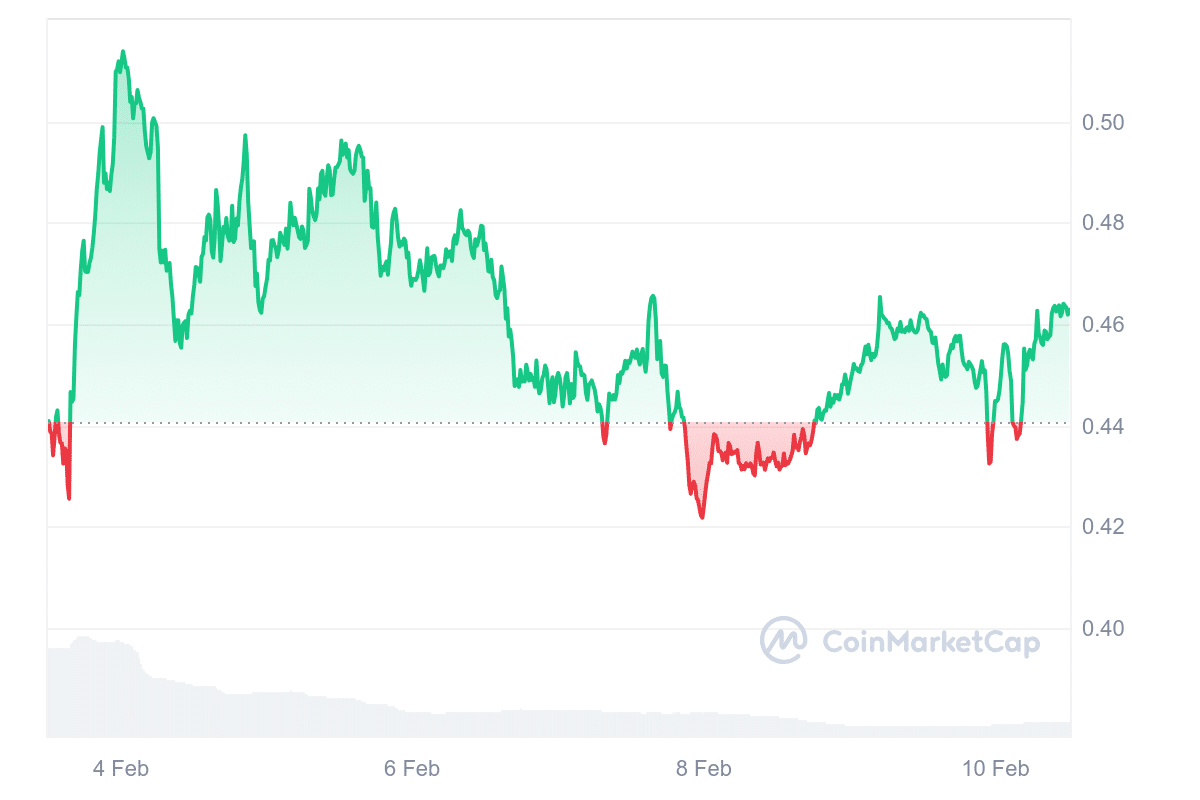

Arbitrum (ARB) is gaining traction with new integrations and innovations. Its current price is $0.4626, reflecting a 4.94% increase over the past week. The market cap is $2 billion, while 24-hour trading volume has surged by 27.93% to $173.18 million. The volume-to-market cap ratio is 0.1173, indicating strong liquidity.

Developers have introduced a Universal Intent Engine to enhance cross-chain interoperability. This simplifies swaps and transfers, making Arbitrum more accessible. Additionally, Arbitrum has integrated with BitcoinOS (BOS) to leverage Bitcoin’s security. This integration allows Arbitrum One to function as a hybrid rollup, expanding its use cases.

In gaming, Xai Play by Xai Games links Steam achievements to Arbitrum’s blockchain. Players can earn rewards based on achievement rarity, driving engagement. Meanwhile, the ETHDenver Brand Hackathon shapes Ethereum’s branding, further promoting Arbitrum’s ecosystem.

Introducing Xai Play by @XAI_GAMES

With this, players’ gameplay is linked to Xai’s Arbitrum chain through their Steam achievements and can be rewarded based on achievement rarity

Link, Earn, Play 🎮 https://t.co/Ec7v1ekwT8

— Arbitrum (@arbitrum) February 7, 2025

Market forecasts for February suggest a price increase of 75.97%, with an average price of $0.8132. The potential range is between $0.4321 and $1.4659, offering a 217.19% ROI. Analysts predict a 267.71% price surge in March, with an average of $1.6993. The expected range is $1.3343 to $2.04, with a potential ROI of 341.05%.

Arbitrum’s growing adoption and strong liquidity indicate a bullish trend. Its increasing integration with Ethereum and Bitcoin strengthens its long-term potential. ARB could surpass $2 by March 2025 if market conditions remain favorable.

2. Onyxcoin (XCN)

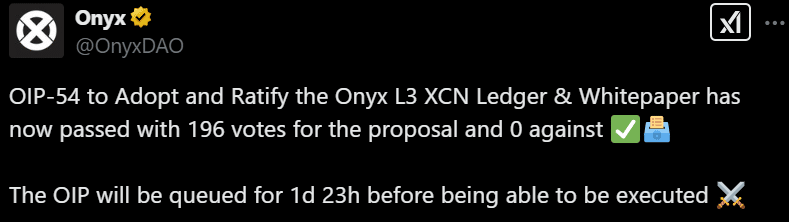

Onyxcoin (XCN) is making strides with its new Layer 3 blockchain, the XCN ledger. This blockchain is built on Arbitrum Orbit, offering near-instant confirmations and low fees. It leverages Base (Coinbase’s L2) as its economic layer, ensuring cost-efficient and high-performance transactions.

XCN is priced at $0.02479, reflecting a 4.69% increase over the past week. Its market cap is $763.44 million, while 24-hour trading volume has surged by 27.45% to $113.43 million. The asset has high liquidity and is trading 699.88% above its 200-day SMA ($0.003163).

XCN’s growth over the past year has been remarkable. It has increased by 1,396% and outperformed 97% of the top 100 cryptos. It has also outperformed Bitcoin and Ethereum while maintaining a strong bullish sentiment. However, the Fear & Greed Index stands at 43, indicating some market caution.

Analysts forecast a 106.81% increase in February, with an average price of $0.05246. The potential range is $0.02775 to $0.09478, offering a 273.62% ROI. In March, predictions suggest a 333.30% price surge, with an average of $0.1099. The expected range is $0.0862 to $0.1319, with a potential ROI of 419.92%. XCN’s technical strength and integration with Arbitrum and Base indicate long-term potential. If market conditions remain favorable, XCN could see further upside in 2025.

3. Algorand (ALGO)

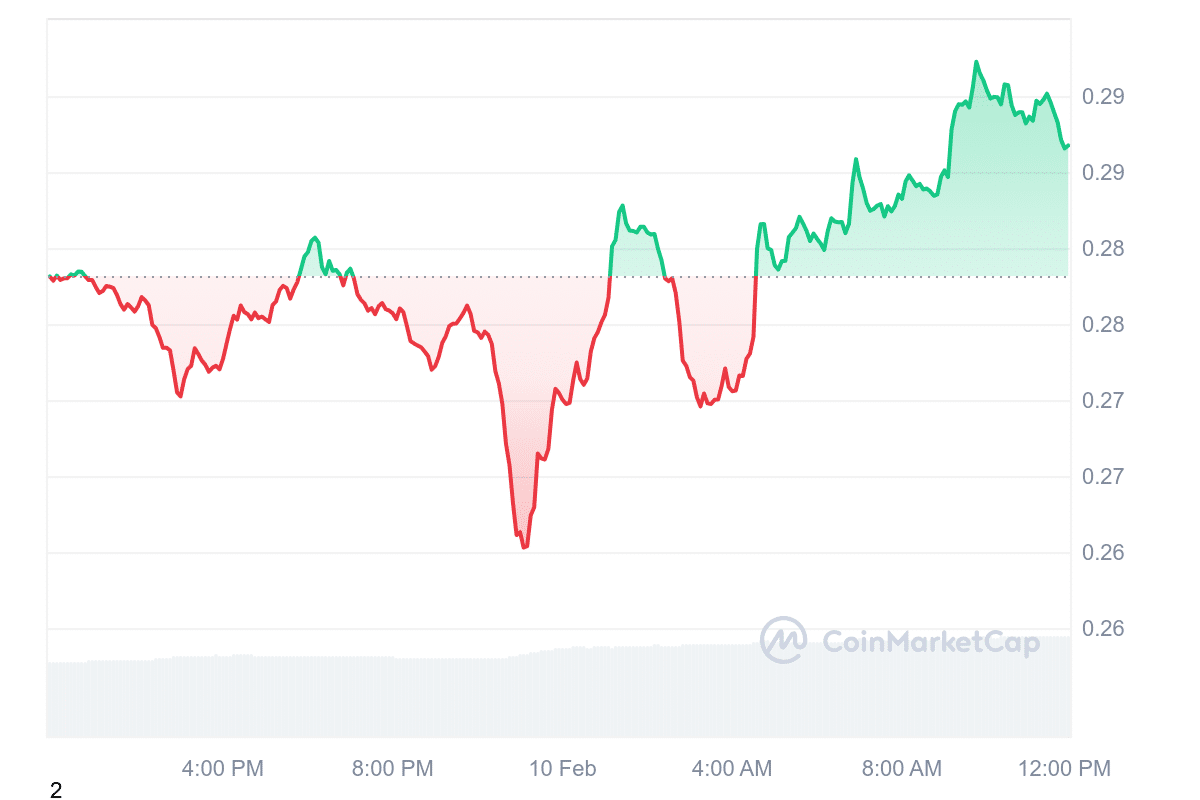

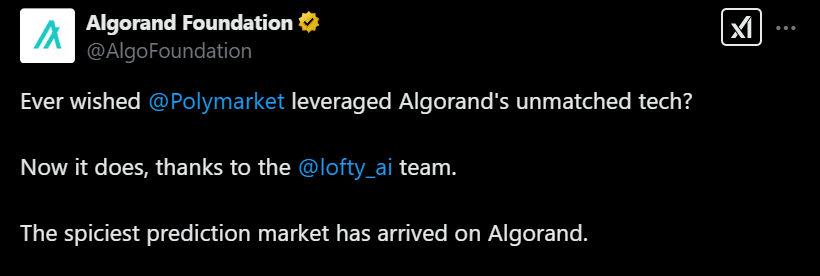

Algorand (ALGO) has shown steady growth in the market, currently trading at $0.2867 with a daily increase of 3.09%. Its market cap is $2.41 billion, reflecting a 3.08% rise, while 24-hour trading volume has jumped 34.72% to $149.66 million. The Fully Diluted Valuation (FDV) is $2.86 billion, and liquidity remains high.

Over the past year, ALGO has gained 64%, outperforming 66% of the top 100 crypto assets. It is trading 10.02% above its 200-day SMA ($0.2631), suggesting strong market sentiment.

February forecasts suggest minimal growth of -0.64%, with an average price of $0.28798. The expected range is $0.26802 to $0.32045, offering a potential ROI of 10.56%. In March, analysts expect a 0.13% price increase, with an average price of $0.29023. The price may fluctuate between $0.27655 and $0.30408, resulting in a potential ROI of 4.91%.

Algorand’s consistent performance and strong liquidity make it an appealing asset for investors. Its steady growth above the 200-day SMA and market resilience indicate that ALGO could maintain an upward trajectory.

4. Cardano (ADA)

Cardano’s partnership with Walmart through the ADA cashback initiative via the Yoroi wallet is significant in increasing cryptocurrency adoption in mainstream commerce. This collaboration highlights the growing acceptance of digital assets in everyday transactions.

In the last 24 hours, Cardano’s price dropped 0.62% to $0.701, while its trading volume surged 45.53% to $776.23 million. ADA is priced at $0.6987, reflecting a 2.52% gain over the past week. Its market cap is $24.59 billion, marking a 0.44% increase, and its 24-hour volume has climbed 48.05% to $783.41 million. Over the past year, ADA’s price has risen by 27%, outperforming 58% of the top 100 crypto assets. It remains highly liquid due to its large market capitalization.

Analysts predict ADA could rise by 24.40% in February, reaching an average price of $0.87298. The expected range is between $0.6961 and $1.0497, offering a potential ROI of 49.58%.

By March, projections indicate a 36.43% price increase, with an average price of $0.95735. The anticipated high is $1.05849, and the low is $0.88670, resulting in a potential ROI of 50.84%. Given its strong market presence and continued adoption, Cardano remains a promising investment for long-term holders.

5. Solaxy ($SOLX)

Solaxy ($SOLX) introduces a Layer-2 scaling solution to address Solana’s well-known issues, such as network congestion and failed transactions during peak demand. Processing transactions off-chain seeks to improve efficiency while maintaining affordability on the leading network.

Currently priced at $0.00163, SOLX is in its presale phase, with an expected price increase in the next round. The project has raised over $19 million, which could accelerate its plans for an exchange listing, tentatively set for Q2 or Q3 of 2025.

Solaxy also plans to bridge Solana with Ethereum, enhancing cross-chain compatibility. This feature could be particularly useful for decentralized applications (dApps) requiring fast transactions. As Solana’s activity grows—driven by new tokens such as $TRUMP and $MELANIA—scalability solutions like Solaxy may become increasingly relevant. Additionally, the platform offers staking opportunities, with potential annual yields of up to 212%. Overall, Solaxy is a possible solution to Solana’s network challenges.

Learn More

Newest Meme Coin ICO – Wall Street Pepe

- Audited By Coinsult

- Early Access Presale Round

- Private Trading Alpha For $WEPE Army

- Staking Pool – High Dynamic APY

Join Our Telegram channel to stay up to date on breaking news coverage